cryptocurrency tax calculator uk

In the UK HMRC treats tax on cryptocurrency like stocks and so any realised gains are subject to Capital Gains Tax. When you sell or trade crypto you have to pay tax on the difference between the selling price and the price you bought it for minus any exchange fees.

![]()

Cointracking Crypto Tax Calculator

Additionally for each sale or exchange you will need the following information.

. This allowance was 12500 for the 20202021 tax year. If activities are considered trading they will face different cryptocurrency tax in the UK. You pay no CGT on the first 12300 that you make.

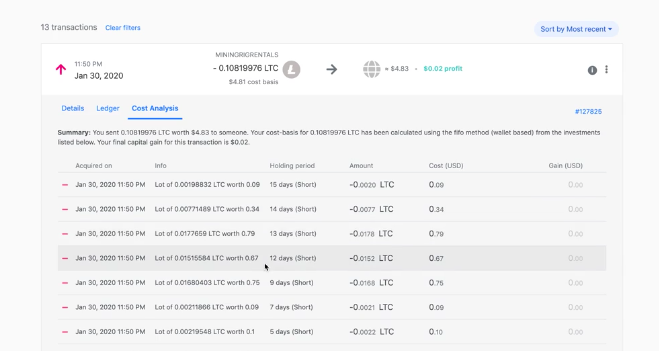

Youll need your transaction history in order to track your tax lots. Using the Trading and Property Allowance you can deduct 1000 of income from your taxable income when you trade or live abroad. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto.

In October 2021 HMRC was reportedly planning to send out nudge letters to holders of cryptocurrency also called cryptoassets or just crypto reminding them to check that they were reporting correctly and paying the required amount of tax. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. Tax on this cryptocurrency exchange in the UK will include capital gains tax.

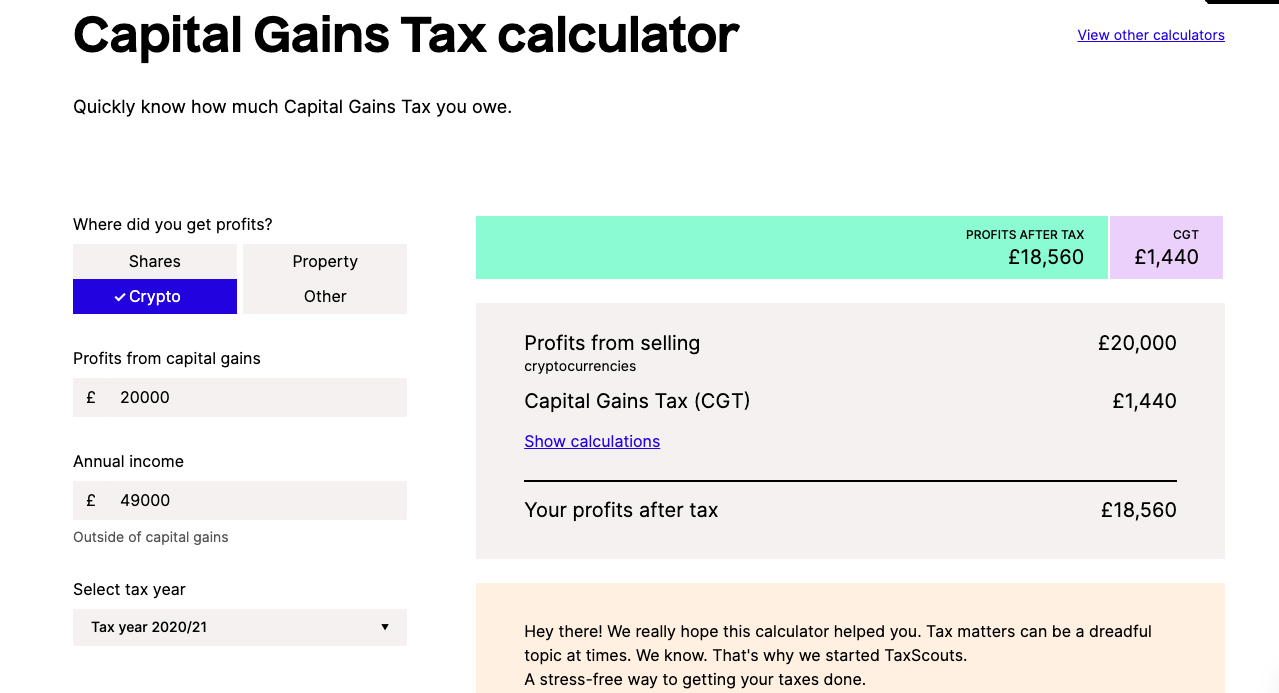

Crypto-currency tax calculator for UK tax rules. Just by entering a few basic details on the calculator one can ascertain the short or long-term capital gains tax depending on the holding period. You can cash in or give away 12300 worth of gains a year tax-free but then pay 10 tax for basic ratepayers or 20 for higher ratepayers.

Stay focused on markets. The original software debuted in 2014. From a tax perspective investing in cryptocurrency is very similar to investing in other assets like stocks bonds and real-estate.

However exchange of one cryptocurrency for another will also be considered disposal. Uk crypto tax calculator with support for over 100 exchanges. The calculator focuses mainly on Bitcoin investors though it can be utilized for those holding any token or cryptocurrency.

So is there a crypto tax in the UK. This is known as a Capital Gains Tax and has to be paid in most countries such as the USA UK Canada etc. HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to pay and what records they need to keep.

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. Download your tax reports in minutes and file with TurboTax or your own accountant. Let us handle the formalities.

Crypto bitcoin united-kingdom tax cryptocurrency tax-calculator hmrc cryptoasset capital-gains tax-calculations cryptotax tax-reports Resources. We offer full support in US UK Canada Australia and partial support for every other country. Crypto tax breaks.

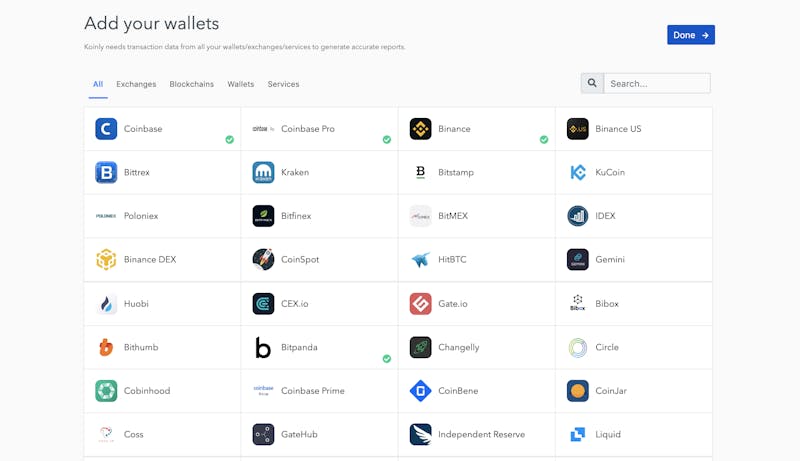

Our platform allows you to import transactions from more than 450 exchanges and blockchains today. Beyond that level there are three tax brackets in the UK. Basic tax rate of 20 between 12501 to 50000 income.

This includes popular cryptocurrency exchanges like Coinbase Binance FTX Uniswap and Pancakeswap. Additional tax rate of 45 beyond 150000. Of course there is a wide range of tax reliefs and allowances to take advantage of so you are not hit with the full brunt of.

However when it comes to taxing them it depends on how the tokens are used. That means you calculate your capital gains and if the result is below the limit you dont need to. Using the first 12570 of your earnings in the UK is not subject to income tax.

Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. How to report and pay the right amount of tax. The cryptocurrency tax calculator handles this automatically using your investment and trading history.

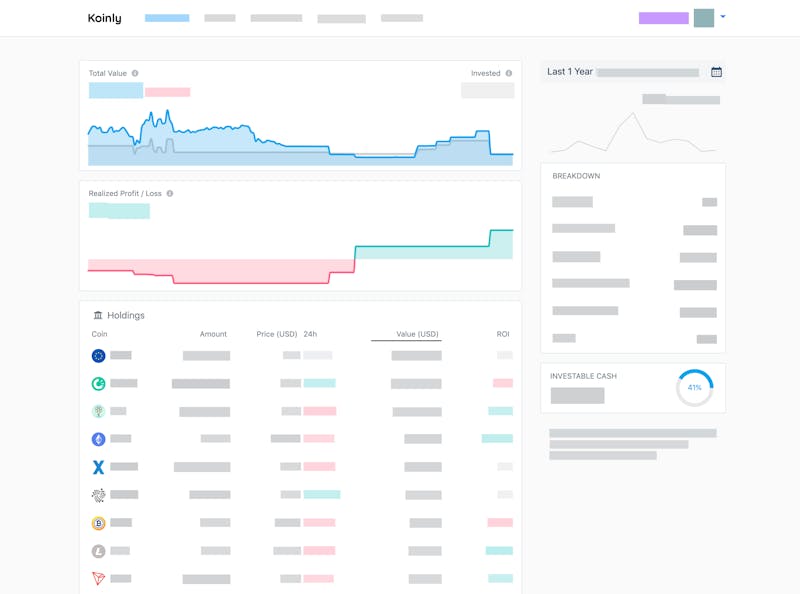

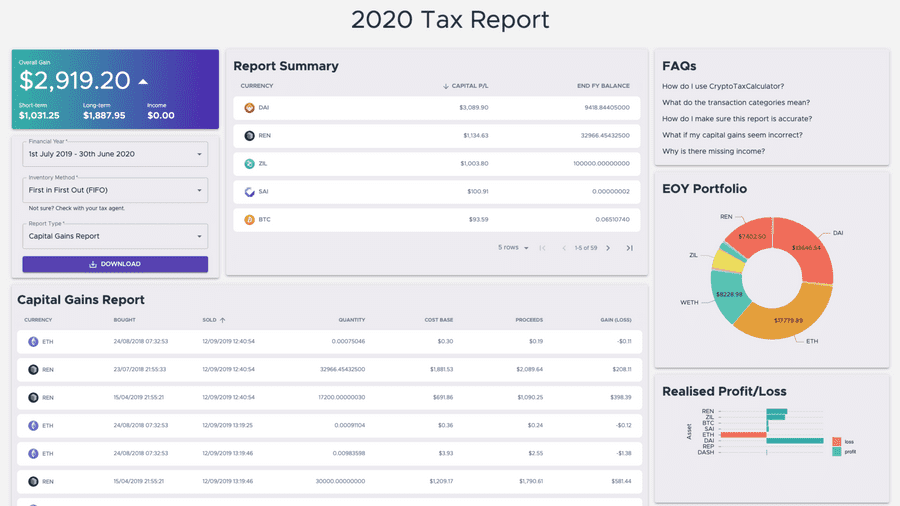

With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. Your first 12570 of income in the UK is tax free for the 20212022 tax year. How Can I Avoid Paying Tax On Cryptocurrency Uk.

HMRC doesnt consider cryptoassets to be a form of money whether exchange tokens utility tokens or security tokens. TaxAct Bitcoin Tax Calculator. UK crypto tax basics.

Under UK crypto tax rules profits on cryptocurrency disposals are considered capital gains and are accordingly subject to capital gains taxes. Higher tax rate of 40 between 50001 to 150000. CoinTrackinginfo - the most popular crypto tax calculator.

UK crypto investors can pay less tax on crypto by making the most of tax breaks. How to calculate your uk crypto tax calculating cryptocurrency in the uk is fairly difficult due to the unique rules around accounting for capital gains set out by the hmrc. CoinTracker helps you become fully compliant with cryptocurrency tax rules.

To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales. You pay 127 at 10 tax rate for the next 1270 of your capital gains. Stop worrying about record keeping filing keeping up to date with.

12570 Personal Income Tax Allowance. How do cryptocurrency taxes work. Crypto is taxed in the same way as Gold and real estate.

The TaxAct Bitcoin Tax Calculator is one of the easiest-to-use free crypto tax calculators online. A Bitcoin tax calculator is a tool that helps Bitcoin owners automate the calculator of short-term capital gains tax and the long-term capital gains tax on profit from bitcoins. Whilst cryptocurrency is a relatively new asset the regulations surrounding it are still being formed.

Become tax compliant seamlessly. For individuals income tax supersedes capital gains tax and applies to profits. Full support for US UK Canada and Australia and partial support for others.

Coinpanda is the worlds most easy-to-use cryptocurrency portfolio tracker and tax software. Our capital gains tax rates guide explains this in more detail. Since then its developers have been creating native apps for mobile devices and other upgrades.

This matters for your crypto because you subtract this amount when calculating what. In your case where your capital gains from shares were 20000 and your total annual earnings were 69000. You have investments to make.

Capital gains tax CGT breakdown.

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

![]()

Cointracking Crypto Tax Calculator

Best Bitcoin Tax Calculator In The Uk 2021

Calculate Your Crypto Taxes With Ease Koinly

Calculate Your Crypto Taxes With Ease Koinly

Best Bitcoin Tax Calculator In The Uk 2021

Crypto Taxes Hmrc Eofy Tax Deadline 31st Jan 2022 Koinly

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick My Personal Journey Through Entrepreneurship Best Crypto Tax Software Bitcoin

Best Bitcoin Tax Calculator In The Uk 2021

Top 8 Crypto Tax Software Alternatives To Cointracking Updated 2021 Coincodex

Capital Gains Tax Calculator Ey Global

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

Bitcoin Tax Calculator India Bitcoin Transaction Bitcoin Startup Company

Best Bitcoin Tax Calculator In The Uk 2021

Track Your Cryptocurrency Portfolio Taxes Cointracker Is The Most Trusted And Secure Cryptocurrency Portfolio Tr Tax Guide Cryptocurrency Buy Cryptocurrency

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Bought Note Purchase Format In Gst Five Shocking Facts About Bought Note Purchase Format In Gst In 2020 Income Tax Payroll Taxes Shocking Facts

The Uk Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda